maryland local earned income tax credit

Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

Earned Income Tax Credit Now Available To Seniors Without Dependents

In May 2019 Governor Larry Hogan R signed legislation to significantly increase the.

. EITC is a tax benefit for low-and moderate-income workers worth up to 5751 for families. Local income tax revenues decrease due to additional local earned income tax credits claimed against the personal income tax. It is important to note that Montgomery County.

Standard mileage and other information. Ii Primary Staff for This Report. 36 rows For you and your family.

IRS-certified staff check for tax credits like the Earned Income Tax Credit and help Marylanders get their refund quickly with direct deposit. It is the nations most effective anti-poverty program. Individuals should complete this form to.

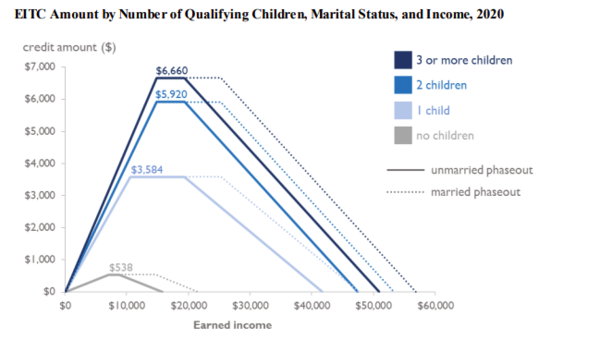

See Worksheet 18A1 to calculate any refundable earned. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. If you qualify you can use the credit to reduce the taxes you owe.

Beginning January 1 2016 law enforcement officers can claim an income tax subtraction modification for the first 5000 of income earned if. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. Data on earned income tax credit claimants.

Chapter 8 and 9 assess the. The state EITC reduces the. Local officials set the rates which range between 225 and 320 for the current tax year.

Average tax credits per tax return for these ZIP Codes range from a high of 3060 in Park Hall 20667 in Saint Marys County to a low of 2668 received in Southwest. Earned Income Tax Credit. 502LC also calculates a local tax credit for income taxes paid to another state or to a local jurisdiction in another state for tax years 2012-2014.

Local income tax revenues decrease by. Earned Income Credit EITC Advance Child Tax Credit. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. CASH Campaign of Maryland 410-234-8008 Baltimore Metro. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe.

Required to file a tax return. Detailed EITC guidance for Tax Year 2021 including. You should report your.

You must file taxes. The income can be from wages pensions or. 2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit.

1 The law enforcement officer resides. Earned Income Tax Credit The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Chapter 7 discusses earned income tax credit improper payments and the use of refund anticipation products.

In response to COVID-19 residents. You must first have worked in jobs covered by Social Security in order to be eligible to apply for Social Security disability benefits. If you qualify for the federal earned income tax credit.

The local income tax is calculated as a percentage of your taxable income.

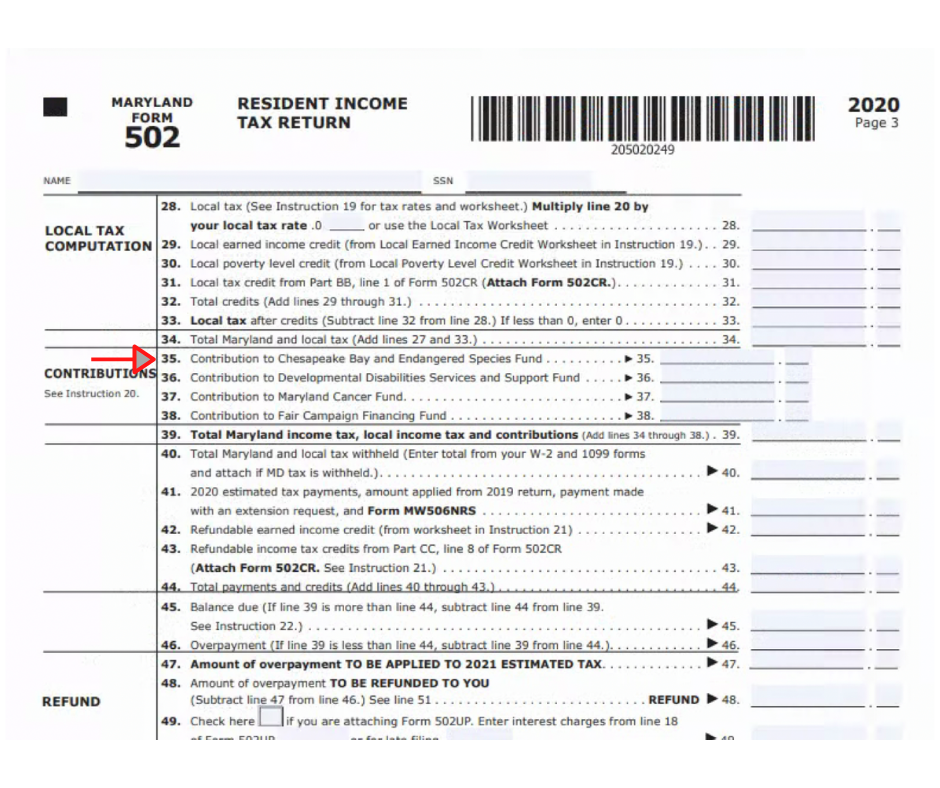

Form 502 Maryland Resident Income Tax Return

State Policy And Practice Related To Earned Income Tax Credits May Affect Receipt Among Hispanic Families With Children Child Trends

Earned Income Tax Credit Expansion Quietly Becomes Law Maryland Matters

Maryland Paycheck Calculator Smartasset

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Tax Season 2022 Last Day To File And Where To File In The Dmv Wusa9 Com

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

2020 Form Md 502up Fill Online Printable Fillable Blank Pdffiller

Resident Book B Amp W Internet The Comptroller Of Maryland

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

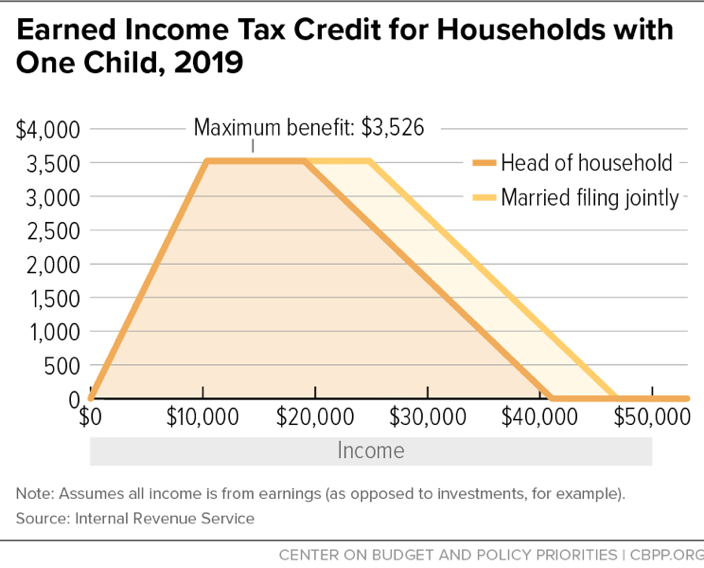

Policy Basics State Earned Income Tax Credits Center On Budget And Policy Priorities

Local Income Taxes In 2019 Local Income Tax City County Level

Maryland Income Taxes Are Due This Friday Eye On Annapolis Eye On Annapolis

Earned Income Tax Credit Wikipedia

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

State Federal Governments Getting Behind Earned Income Tax Credits National Conference Of State Legislatures

Expanding The Earned Income Tax Credit Will Benefit Maryland Workers And The Economy Maryland Center On Economic Policy